Establish your presence globally with Neeyamo as we help you go beyond borders to manage your international payroll and hire new talent in Russia.

Overview

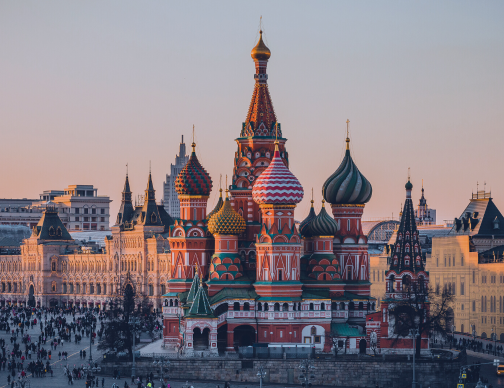

Russia, the world's largest country, is home to an astonishing 20% of the world's trees, predominantly concentrated in the remote reaches of Siberia, largely untouched due to the harsh climate and inaccessibility. While these natural resources may remain out of reach, Russia offers a highly skilled workforce readily accessible to organizations worldwide through an Employer of Record (EOR) service provider.

For organizations considering expansion into Russia, the challenge of hiring local talent can be effectively addressed, even without a physical entity in the country. Global payroll companies such as Neeyamo specialize in facilitating the seamless onboarding and management of employees in Russia. These comprehensive services also encompass processing payroll and tax services, local and global payroll regulations management, benefits administration, and more, thereby mitigating operational complexities associated with global expansion.

Tools And Instances

Facts And Stats

Capital

Moscow

Currency

Russian Ruble (RUB)

Official Language

Russian

Fiscal Year

1 January - 31 December

Date Format

DD/MM/YYYY

Country Calling Code

+7

Time Zone

There are eleven time zones in Russia, which currently observe times ranging from UTC+02:00 to UTC+12:00

Global Payroll

Overview

Handling payroll for a widespread workforce can pose a significant challenge for any organization, and the added complication of compliance can make things worse. If companies spend more time processing payroll, it directly impacts day-to-day operations and their overall productivity. The solution to this is Global Payroll Outsourcing using outsourced payroll providers.

Over the years, Neeyamo – Global Payroll Services has observed these complexities and strived to provide a global payroll solution through a single technology platform - Neeyamo Payroll.

How is payroll done?

Neeyamo acts as an employer's payroll tax calculator, ensuring adherence to local regulatory requirements using multi-level controls. Benefits of the payroll system include providing timely and accurate payroll - courtesy of our experts worldwide and using a tech-based integrated smart helpdesk solution with seamless support experience manned by payroll business solution experts - Neeyamo has all your payroll needs covered.

Payroll Taxes

Payroll tax is the percentage amount retained from an employee's salary and paid to the government to invest in the general population's welfare. These are statutory in nature and are levied from both the employer and employee. Additional statutory contributions are made by employers towards aiding both short-term and long-term benefits for their employees.

Employee Taxes

Employees are expected to pay 13% of their taxable income up to 5 million Rubles as income tax. They don’t have any other contribution.

Employer Taxes

The employer contribution in Russia is as follows:

State Pension Fund: 22.0% up to wages of 1,565,000 RUB per year (Maximum rate) 10% for any amount over the maximum

Social Insurance Fund: 2.9% up to 2.9% up to wages of 1,032,000 RUB per year (Maximum rate), with the excess not subject to contribution RUB per year (Maximum rate)

Medical Insurance Fund: 5.10%

Accident Insurance (dependent on the degree of inherent risk in the employee’s occupation): 0.2% to 8.5%

Total Employment Cost: 30.02% to 38.50%

Payroll Cycle

Overview

Undoubtedly, payroll is a critical process for any organization. The pay cycle in Russia refers to the period for which an organization pays its employees, and this can vary depending on the pay frequency that the organization chooses to adopt.

Frequency

In accordance with Russian law, wages must be paid on a day designated by the work regulations, a collective bargaining agreement, or an employment contract at least once every two weeks. Companies must now make compensation payments within 15 calendar days of the end of the payroll month.

13th Month Cycle

In Russia, 13th-month wage payments are not mandated by law.

Global Work

Overview

An Employer of Record services (EOR) provider helps you eliminate the hassle of handling complexities while onboarding a new employee in an international location. They help bridge the gap that otherwise mandates organizations to have a local registered entity and a local bank account, prior to making a job offer to an international hire.

An Employer of Record services (EOR) provider acts as a legal employer, facilitates salary payments, and manages other statutory requirements such as health insurance, payroll taxes, and employee benefits ensuring compliance with local tax laws and regulations.

This allows organizations to focus on collaborating with the employee in Russia for operational tasks, with the knowledge that they have a cost-effective solution like Neeyamo to support their employer of record, payroll services, and HR requirements, as they continue their global expansion.

HR Mandates and Practices

Minimum Wage

With effect from January 1, 2023, the minimum wage is increased to 16,242 rubles per month from 15,279 rubles per month.

Overtime

Overtime cannot exceed 4 hours in 2 consecutive days or 120 hours in a year for each employee.

Pay – Overtime pay is 1.5 times the regular rate of pay for the first two hours beyond normal working hours and two times the regular rate of pay for all working hours beyond that. At the request of the employee, time off in lieu can be given instead of increased pay, but not less than the time worked overtime.

Collective bargaining agreements can also address the specific compensation granted during overtime work. Employees must give written consent to work overtime. Labor Code, 2001, No. 197-FZ (as amended), arts. 99 (Russian), 152.

Data Retention Policy

Tax records must be kept for a minimum of five years in Russia.

Employers are responsible for retaining employee workbooks, records of wages, and total hours worked for the employer. Employers must be prepared to submit these documents to employees upon their request and to the tax or labor authorities.

Employers in Russia are responsible for documenting all relevant employee activity in workbooks, which all employees possess. If necessary, employers must give an employee a new workbook if lost or stolen.

Hiring and Onboarding Requirements

Hiring

Generally, Russian law does not require employers to give preference in hiring particular people or groups of people.

However, some protective measures have been established for certain groups of people. For instance, the Federal Law on Employment of the Population of the Russian Federation and the Federal Law on Social Protection of the Disabled in the Russian Federation set a quota for the number of disabled people that a company with more than 100 employees is required to hire. The quota is established by regional laws but should be in the range of 2 to 4 percent of the average weighted number of such a company’s employees.

Russian law prohibits employment discrimination based on criteria other than the employee’s skill. Also, article 64 of the Labour Code specifically prohibits any ‘limitations’ when hiring pregnant women, women with children, and certain other categories of employees. Further, an employer cannot refuse to hire employees who are being transferred from another employer.

Onboarding

Once you hire Russian employees, you need to obtain certain documents to onboard them:

- Passport and Russian work visa

- Personal Identity Documents

- Educational Documents

- Various documents on health and safety

Probation

Leave

Public Holidays

Employees are entitled to the following 14 paid public holidays(nonworking holidays):

- Jan. 1 to Jan. 8: New Year holidays;

- Jan. 7: Nativity of Christ

- Feb. 23: Defenders of the Fatherland Day

- Feb 24: Public Holiday

- March 8: International Women’s Day

- May 1: Spring and Labor Day

- May 8: Public Holiday

- May 9: Victory Day

- June 12: Russia Day

- Nov. 4 and Nov. 6: National Unity Day

Sick Leave

Employees can take sick leave in the event of illness or injury. Sick leave can also be granted to an employee taking care of a sick child or sick relative.

Medical care is free to employees through the social security system and is partially funded by employers. Employees unable to work due to non-work-related illness or other injury are entitled to sick leave compensation until they can return to work. The employer pays a temporary disability allowance for the first three days and the Social Insurance Fund pays for the remainder of the time.

The employer can offset its expenses against its Social Insurance Fund liability. The amount of the sick leave benefit depends on how long an employee has been covered under the social security system:

- Less than six months: minimum wage;

- More than six months and up to five years: 60% of average earnings;

- More than five years and up to eight years: 80% of average earnings; and

- More than eight years: 100% of average earnings.

These amounts are paid for the first 10 days of leave. Thereafter, payments are reduced by 50 percent.

Maternity Leave

Female employees are entitled to 70 days of paid pre-natal leave, extended to 84 days if more than one child is expected, and 70 days of postnatal leave, extended to 86 days in cases of complications in childbirth or 110 days in the event of the birth of two or more children.

Maternity leave shall be calculated in total & granted to a female employee regardless of the number of days she actually used before giving birth.

Pay – Allowances during pregnancy and maternity leave are paid by the Social Insurance Fund. Labor Code, 2001, No. 197-FZ (as amended), arts. 255 (Russian).

Paternity Leave

Until the child is 18 months old, the relative or guardian who looks after the child may ask for paid parental leave at any time. The Russian Federation's Social Insurance Fund is responsible for paying the allowance.

Following the birth of a child, employees are entitled to up to five days of unpaid leave.

The same protections afforded to women are extended to workers raising children without a mother.

Once accepted by both the employer and the employee, employees may be permitted extra leave kinds depending on the contract or collective agreement.

Annual Leave

Under Russian law, an employer must provide an employee with annual paid leave. The minimum entitlement to annual paid leave in Russia is 28 days. Full-time employees and part-time employees have equal rights to annual paid leave.

In addition, some categories of employees are entitled to extend annual paid leave. For example:

- Employees under the age of 18 are entitled to annual paid leave of at least 31 calendar days.

- Disabled employees are entitled to at least 30 calendar days.

- Teachers and other employees who work in education are entitled to at least 42 calendar days.

- Public officers (e.g. prosecutors, judges, other civil servants) are entitled to 30 calendar days or more, depending on the specific type of work.

Bereavement Leave

Employees are entitled to five days of paid leave for a family member's death during bereavement.

Study Leave

Employees who are enrolled in a higher education program are entitled to 40 days of paid leave during the first two years of study and 50 days of paid leave for the remaining study period. The employer is responsible for covering this benefit.

Military Leave

Employees are entitled to up to 14 calendar days of unpaid leave per year if they are parents or spouses of military people, who have been killed or gravely injured while serving in the military, or who have contracted a sickness linked to military service.

Education Leave

For employees who are sent for training by an employer or who have enrolled independently for training under state-accredited bachelor’s programs, in correspondence and part-time forms of study and who successfully master these programs, the employer provides additional paid leaves for:

- passing the intermediate certification in the first and second courses, respectively – for 40 calendar days, for each of the subsequent courses, respectively – for 50 calendar days (when mastering educational programs of higher education in a shorter period in the second year – 50 calendar days)

- passing the intermediate certification in the first and second courses of secondary vocational education- 30 calendar days, in each of the subsequent courses – 40 calendar days;

- passing the state final certification – up to 4 months in accordance with the educational program of higher education mastered by the employee; up to 2 months in accordance with the educational program of secondary vocational education being mastered by the employee.

Unpaid Leave

The employer is obliged, based on a written application from the employee, to provide leave without pay:

- participants of the Great Patriotic War – up to 35 calendar days a year;

- working old-age pensioners (by age) – up to 14 calendar days a year;

- parents and wives (husbands) of military personnel, employees of the internal affairs bodies, the federal fire service, customs authorities, employees of institutions, and bodies of the penal system who died or died as a result of injury, contusion, or injury received in the performance of military service (service) duties, or due to a disease associated with military service (service), up to 14 calendar days a year;

- working disabled people – up to 60 calendar days a year;

- employees in cases of childbirth, marriage registration, and death of close relatives – up to 5 calendar days;

- in other cases provided for by this Code, other federal laws, or a collective agreement.

The employer is obliged to provide unpaid leave:

- Employees admitted to entrance examinations – 15 calendar days; 10 calendar days for secondary vocational education.

- 10 calendar days in the academic year for passing the state final certification in secondary vocational education – up to 2 months.

- employees – students of preparatory departments of educational institutions of higher education for passing the final certification – 15 calendar days;

- employees studying in state-accredited bachelor’s programs, special programs, or master’s programs in full-time education, combining education with work, to undergo intermediate certification – 15 calendar days in the academic year,

- to prepare and defend the final qualifying work and the final state exams – 1 month, for the final state exams – 1 month

Termination

Notice Period

The employer must serve notice of dismissal to employees in the following cases:

- Three days’ notice in the case of termination of a fixed-term employment contract

- Three days’ notice in the case of termination of the employment contract during a probationary period

- Two months’ notice (or seven days for seasonal workers and three days for termination of employment contracts with a maximum of two months) in the case of closure of the organization or redundancy

Any other cases where this is a legal requirement.

Severance Pay

Employees are entitled to a severance payment of two weeks’ average salary if they are dismissed for the following reasons:

- the employee’s refusal to be transferred to another job, as required for health reasons;

- the employee has been called for military service;

- reinstatement of someone who used to do the same job;

- the employee’s refusal to be transferred to a job at another location with the employer;

- the fact that the employee can no longer do the job for health reasons;

- the employee’s refusal to continue working because of amendments to the employment contract

The average salary is calculated based on all payments made to the employee over the past 12 months (e.g. salary, bonuses, compensation, and other benefits).

Employees are entitled to the following severance payments in cases of redundancy or closure of the organization:

- One month’s average salary (to be paid on the last day of employment).

- One month’s average salary for the period of employee’s placement (i.e. job search). This must be requested by the employee within 15 working days after the second month following the date of dismissal and must be paid within 15 calendar days from the date of the application.

- One additional month’s average salary if the employee fails to find another job within three months of dismissal, provided that he or she registered with an employment center within two weeks of the date of dismissal. This must be requested by the employee within 15 working days after the third month following the date of dismissal and must be paid within 15 calendar days from the date of the application.

Visa

Overview

To live and work in Russia, an employee needs both a visa and a Russian work permit.

Overview

There are two different types of visas:

This visa is single-entry and is good for 90 days. Based on a work visa invitation, which employees receive once they obtain a work permit, the Russian Consulate will provide it.

Multiple-entry: Depending on how long the work permit is valid, the local office of the Russian Migration police will reissue the multiple-entry visa.

Additionally, workers must possess a Russian work authorization. For the duration of the employment contract, anyone from a non-Commonwealth of Independent States (CIS) nation may apply for a normal work permit. A temporary residence permit must first be obtained. The work permit for highly qualified professionals, which is handled more quickly, is available to qualified professionals making over 1 million RUB annually. This three-year authorization enables family members to apply for Russian visas.

All workers in the Russian Federation must schedule an appointment with a doctor due to the nation's additional limitations on those traveling with HIV/AIDS. All patients must undergo tests for leprosy, TB, and HIV/AIDS.

Employee Background Checks

Legal and Background Checks

Background checks are not officially recognized in Russia. Instead, article 3 of the Labour Code generally prohibits discrimination when hiring employees, where ‘discrimination’ is broadly interpreted. Russian law only allows hiring decisions based on potential employees’ professional skills.

Further, article 64 of the Labour Code prohibits any ‘preferences’ or ‘limitations’ when hiring. Again, this refers to decisions not solely based on an employee’s skills (ie,’ business qualities’).

If the employer subsequently declines to hire the applicant, the decision could be challenged on discrimination. The applicant could also apply to the Federal Service for Labour and Employment or the prosecutor’s office with a complaint regarding the employer’s discriminatory practices.

Last updated on September 19, 2023

If you have any queries or suggestions, reach out to us at irene.jones@neeyamo.com