Country Spotlight: Payroll in Japan

A known fact: Sumo wrestling is the national sport of Japan.

In Japan, another matter altogether requires the same amount of perseverance and strength and is not that well known.

You can now place your bets on the payroll system in Japan.

Managing payroll can be tricky, irrespective of the country, and Japan is similar. But despite the difficulties that stand in the way, the country has found unique, compelling ways to provide wages to its workers.

Japan's payroll frequency is monthly and is paid on the 25th of every month. The government has also adopted a creative approach to reward employees by paying them incentives through summer and winter bonuses paid in June and December, respectively.

Towards the end of the year, there are two things that organizations primarily follow:

- A customary 13th month salary is paid to the employees at the end of each year.

- The employer also provides the employee with a year-end tax adjustment declaration, Nenmatsu-chosei.

What is Nenmatsu-chosei?

This declaration applies to people who work for either companies or the government. If the person works independently, they must file the final returns themselves.

So, why is this done precisely in the first place?

In Japan, income tax can only be calculated if your annual income is fixed. Since the income tax is paid in December, it leaves out a certain amount during that time.

So, the company assumes how much an employee's income will be, and the tax is calculated tentatively. The income tax is partially deducted from the payroll of every month, i.e., from January to November. In December, the tax is adjusted accordingly. This process, in its entirety, is called Nenmatsu-chosei.

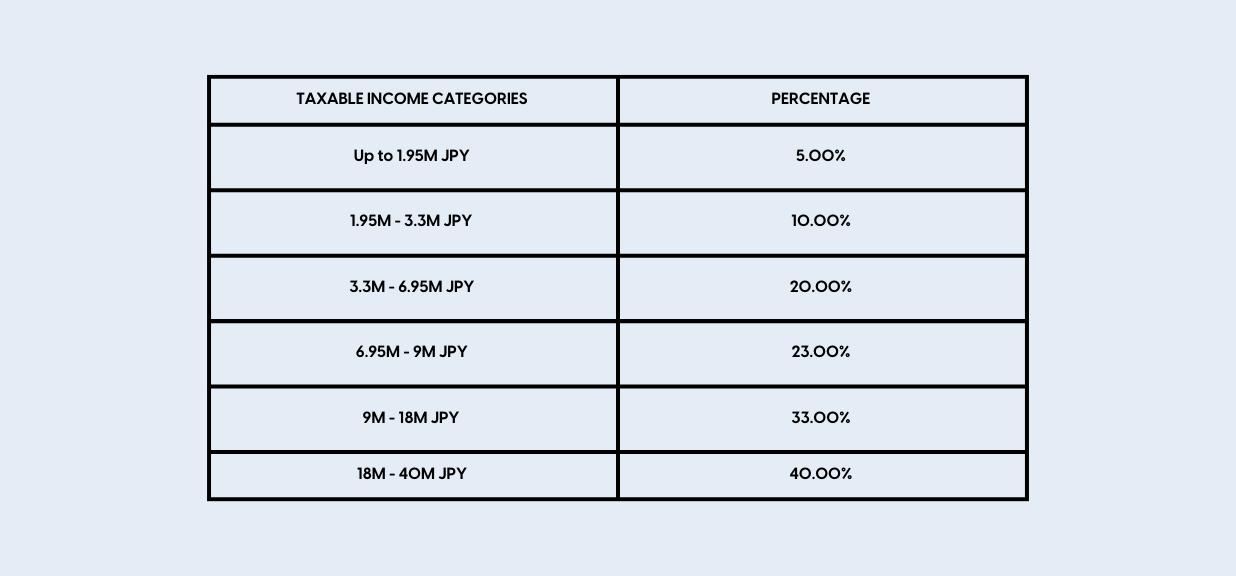

Tax Deduction

There are two types of tax deductions:

- Salary income deduction

- Other income deduction

Salary Income Deduction

The salary income deductions are made based on the income an employee receives as per the following slabs:

Other income deductions include:

- Social insurance premium (Employment, pension, and healthcare insurance)

- Family deduction

- Private insurance deduction

- Donation deduction/li>

- Loss deduction

- Medication deduction

- Mortgage deduction

- Others

The annual income includes basic salary and all allowances. The overtime allowance also falls under the category of annual income.

If the commuting allowance falls below 100,000 yen per month, it does not come under annual income.

With all these deductions in place, it is essential to have a payroll provider who is cognizant of the deductions to be made to ensure a seamless payday experience.

After all, the last thing you would need is to have the smile brought about by getting a paycheck turned upside down when you find out an incorrect deduction was made.

Importance of flexible Absence Management Solution

Public Holidays

There are 16 national holidays in Japan. While there are no legislative requirements for public holidays to be paid, it is customary to award certain days as paid holidays. When a national holiday falls on a Sunday, the next working day is designated as a public holiday.

Maternity Leave

Maternity Leave in Japan is 14 weeks. This is separated into six weeks before birth and eight weeks after. The woman is paid two-thirds of her base wage and is protected by social security.

Parental Leave

Childcare leave can be taken by either the mother or the father in Japan, beginning the day after the maternity leave finishes. Childcare leave is covered by workers' compensation and can be used until the child turns one. If both parents take childcare leave, the leave is prolonged until the child reaches the age of one year and two months.

Under such circumstances, employing an absence system with high flexibility is vital as it can be customized per individual employee requirements.

Neeyamo Absence provides companies with the ability to configure complex absence plans smoothly. It is programmed to reduce set-up time while helping organizations stay compliant and imbibe best practices.

Simplifying the Employee Offboarding Process

If an employer wishes to establish an entity in Japan, then they need to do the following:

- Submit a form to register with the National Tax Agency

- Register themselves with the Social Insurance Office

- Register themselves with Labor Standards Inspection Office

Depending on the designation, place, type of contract, and cause of termination, varying procedures for termination apply.

Although there is no required severance payout, companies should adopt socially acceptable terms due to the difficulty of terminating an employee.

Neeyamo Offboarding helps provide a pleasant employee exit experience with integrated engagement and automated workflows.

Also Read: Overcoming the Global Payroll Challenges in APAC

Japan's payroll system requires a certain amount of perseverance and strength to deal with its complexities. That's why it is crucial to utilize a payroll provider with the right technology to accommodate them effectively.

In the era of advanced machinery, it is hard to talk about technology and not think of Japan. The country has always been synonymous with future-ready technology, from industry-leading brands to magnificent gadgets and bullet trains.

So, when it comes to payroll and EOR, it goes without saying that technology must be intuitive and effective every time.

Neeyamo's Global Payroll and Neeyamo's Global Work were designed to manage and pay employees globally with a technology-first approach at its foundation.

Contact an expert today to find out how we can match up to your requirements to make smarter decisions for a prosperous future.

Latest Resources

Stay informed with latest updates

If you're curious and have a thirst for knowledge pertaining to the HR, payroll, and EOR universe, don't miss out on subscribing to our resources.