Run your business seamlessly with Neeyamo as we help you go beyond borders to manage your international payroll and hire new talent in Brunei.

Overview

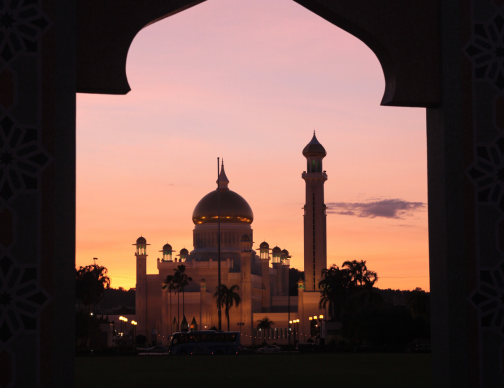

A small nation on the island of Borneo, Brunei is an oil-rich sultanate in the middle of Southeast Asia. With a small population of less than half a million people, Brunei is very dependent on its well-developed oil and gas industry and aims at the diversification of its economy.Oil and gas have been the backbone of Brunei's economy since their discovery in 1929. In line with its diversification efforts and with easy access to hydrocarbon resources, Brunei is a perfect location for the establishment of oil and gas-related industries.

Do your organization's expansion plans require hiring employees in Brunei? Do you lack a physical entity in the country – a key requisite to hire local talent? Neeyamo – one of the top Global payroll providers, assists organizations worldwide with onboarding and managing employees in Brunei- processing payroll, managing local compliance requirements, benefits, and more.

Tools And Instances

Facts And Stats

Capital

Bandar Seri Begawan

Currency

The Brunei Dollar

Official Language

Malay

Fiscal Year

April 1 - March 31

Date Format

DD/MM/YYYY

International Code

+673

Other Languages

Brunei English

Time Zone

UTC + 8

Global Payroll

Overview

Handling payroll for a widespread workforce can pose a significant challenge for any organization, and the added complication of compliance can make things worse. If companies spend more time processing payroll, it directly impacts day-to-day operations and their overall productivity.

Over the years, Neeyamo has observed these complexities and strived to provide a global payroll solution through a single technology platform - Neeyamo Payroll. Cloud-based payroll service providers, like Neeyamo, assess payroll industry trends and offer a consolidated solution in its Global Payroll Technology Stack making outsourcing payroll cost per employee easier.

Payroll Taxes

Payroll tax is the percentage amount retained from an employee's salary and paid to the government to invest in the welfare of the general population.

Employee Taxes

Brunei Darussalam does not impose social security taxes. However, under the government-run Tabung Amanah Pekerja (TAP) and Supplementary Contributory Pension (SCP) employee trust fund schemes.

Under the TAP scheme, employees must contribute at least 5% of their basic salaries to the fund. Brunei does not currently levy any income tax on individuals.

Employer Taxes

Under the government-run Tabung Amanah Pekerja (TAP) and Supplementary Contributory Pension (SCP) employee trust fund schemes, employers must make a contribution at a minimum rate of 5% for their employees.

Under the SCP scheme, the employees’ and employers’ contributions are calculated at a rate of 3.5% of the basic salaries of the employees.

Payroll Cycle

Overview

Undoubtedly, payroll is a critical aspect of any organization. The Pay cycle is a notable feature that provides a sense of accountability for an employee to be paid consistently for their work.

Frequency

The most common payroll cycle observed is Monthly.

13th Month Cycle

There is no statutory requirement to pay the 13th or the 14th month salary.

Global Work

Overview

An Employer of Record service provider helps you get rid of the hassle of handling the complexities that come with setting up a new employee in remote locations. They act as legal employers, facilitate salary payments, and handle everything from health insurance. payroll taxes, and employee benefits to comply with local tax laws and regulations.

This ensures that the client company can focus on the employee’s everyday tasks safely in the knowledge that they have a cost-effective solution as they continue their global expansion.

HR Mandates and Practices

Minimum Wage

The minimum wage for full-time employees is BND500 per month, while part-time workers are entitled to a minimum rate of BND2.62 per hour.

Overtime

Any work performed beyond the standard working hours is considered overtime. An employee cannot work for more than 12 hours in a day inclusive of overtime, except in situations such as accidents, work essential to the life of the community, work essential for national defense or security, etc.

An employee is allowed to work up to a limit of 72 hours of overtime in a month. However, this limit may be exceeded if approval has been granted by the government authority.

Overtime Pay – An employee shall be paid 1.5 times the hourly basic rate of pay for overtime work.

Data Retention Policy

There is no specific data retention schedule for Brunei.

Hiring and Onboarding Requirements

Hiring

The law does not explicitly prohibit discrimination with respect to employment and occupation. There is no law requiring equal pay for equal work.

Employers in Brunei often have a number of preferences when it comes to hiring, including:

- Citizenship: Employers typically prefer to hire Bruneian citizens, as they are not required to obtain work visas.

- Language: Employers typically prefer to hire candidates who are fluent in Malay and English.

Onboarding

The onboarding document requirements for new employees in Brunei vary depending on the specific employer and the employee's position. However, there are some general requirements that are typically required for all IT professionals seeking employment in Brunei.

- General Requirements

- National ID

- Completed Employment Application Form

- Copy of Passport

- Copy of Work Visa (if applicable)

- Copy of Educational Qualifications

- Copy of Professional Certifications (if applicable)

- Two Recent Passport-Sized Photographs

- Original Medical Certificate

- Original Police Clearance Certificate

Probation

The qualifying period is the same as the employee's probation period, which may not exceed 90 consecutive days.

Leave

Public Holidays for 2023

- 1 January: New Year's Day

- 8 February: Isra and Mi'raj (Tentative Date)

- 10 February: Lunar New Year

- 23 February: National Day

- 24 February: Day off for National Day

- 12 March: Ramadan begins (Tentative Date)

- 28 March: Nuzul Al-Qur'an (Tentative Date)

- 10 April: Eid al-Fitr (Tentative Date)

- 11 April: Eid al-Fitr Holiday (Tentative Date)

- 12 April: Eid al-Fitr Holiday (Tentative Date)

- 13 April: Eid al-Fitr Holiday observed (Tentative Date)

- 31 May: Royal Brunei Armed Forces Day

- 1 June: Day off for Royal Brunei Armed Forces Day

- 17 June: Eid al-Adha (Tentative Date)

- 7 July: Muharram (Muslim New Year) (Tentative Date)

- 8 July: Day off for Muharram (Muslim New Year) (Tentative Date)

- 15 July: Sultan's Birthday

- 16 September: Milad un Nabi (Mawlid)

- 25 December: Christmas Day

Annual leave

An employee who has worked with an employer for a period of not less than 3 months shall be entitled to –

Paid annual leave of 7 days in respect of the first 12 months of continuous service with the same employer; and An additional one day’s annual leave for every subsequent 12 months of continuous service with the same employer, subject to a maximum of 14 days of such leave, which shall be in addition to the rest days, public holidays, and sick leave to which the employee is entitled to.

An employee who has been employed with an employer for a period of not less than 3 months but has not completed 12 months of continuous service in any year shall be entitled to annual leave in proportion to the number of completed months of service in that year.

In calculating the proportionate annual leave, any fraction of a day that is less than half of a day shall be not counted, and where the fraction of the day is half or more it shall be considered as 1 day. In cases where an employee has taken leave without pay with the consent of the employer, the period of leave taken shall not be considered for the purpose of calculating continuous service with the employer.

If an employee is absent from work without the approval of the employer or without reasonable excuse for more than 20% of the number of working days in the month or year in which the entitlement to such annual leave accrues, in such cases, will not be entitled to annual leave.

Sick leave

14 days outpatient sick leave per year and 60 days hospitalization leave (including the 14 days outpatient sick leave) provided he satisfies the following conditions:-

- Must have worked for at least 6 months;

- Has obtained a medical certificate from the company doctor. If no such doctor is appointed, from a government doctor or a doctor employed by any of the approved hospitals; and

- Must inform the employer of the sick leave within 48 hours.

Maternity leave

Foreign employees

All foreign female employees are covered under the Employment Order and are entitled to 9 weeks of maternity leave as follows:-

- 4 weeks immediately before the delivery of her child

- 5 weeks immediately after the delivery of her child.

By mutual consent, the last 4 weeks of the maternity leave can be taken within 6 months from the date of delivery.

All female employees must be satisfied that she has served an employer for more than 180 days and only 8 weeks are entitled to receive payment benefit.

Local employees

All citizen or permanent resident female employees are covered under the Employment Order and are entitled to 15 weeks of maternity leave as follows:-

- The period of 2 weeks immediately before the delivery of her child.

- The period of 13 weeks immediately after the delivery of her child.

Eligibility requirements:

- Applies to citizens or permanent residents of Brunei Darussalam.

- Has served an employer for more than 180 days.

- An employee whose contributions are payable by her employer on behalf of the employee under TAP.

- Lawfully married

Termination

Overview

Termination by Commissioner of contract of service:

A contract of service may be terminated by the Commissioner if the employee has been mistreated in person or property, and in such event, the Commissioner may order the employer to award the employee reasonable compensation for such mistreatment.

Termination by employee threatened by danger:

An employee may terminate his contract of service with his employer without notice where he or his dependant is immediately threatened by danger to the person by violence or disease such as the employee did not by his contract of service undertake to run. When the contract of service is deemed to be breached by employer and employee.

An employee shall be deemed to be in breach of his contract of service with the employer if he has been continuously absent from work for more than 2 days-

- Without prior leave from his employer or without reasonable excuse; or

- Without informing or attempting to inform his employer of the reason for the absence.

Notice Period

(1) Either party to a contract of service may at any time give to the other party notice of his intention to terminate the contract of service.

(2) The length of such notice shall be determined by the contract of service or, in the absence of any provision, the notice to terminate a contract of service shall be not less than -

- one day's notice, if the employee has been employed for less than 26 weeks;

- one week's notice, if the employee has been employed for at least 26 weeks but less than 2 years;

- 2 week's notice, if the employee has been employed for at least 2 years but less than 5 years;

- 4 week's notice, if the employee has been employed for at least 5 years.

This section does not prevent either party from waiving his right to notice on any occasion. The notice to terminate shall be in writing and may be given at any time, and the day on which the notice is given shall be included in calculating the period of the notice.

Severance Pay

When is salary payable to an employee whose contract of service has been terminated by his employer?

The payment upon termination depends on the terms of the employment contract and the reason for termination. There is no specific statutory requirement for severance pay in Brunei.

The total salary due to an employee must be paid on his last day of employment if:-

- He is dismissed on the grounds of misconduct

- His service is terminated by his employer

If this is not possible, it must be paid within 3 working days from the date of dismissal or termination.

When is salary payable to an employee who resigns?

- If an employee resigns and has served the required notice period, he must be paid all salary due to him on the last day of employment

- If an employee resigns without notice or without serving the required notice period, he must be paid all salary due to him within 7 days from the last day of employment.

Visa

Overview

In Brunei, every foreigner intending to work must have a valid Employment Visa authorized by the Department of Immigration and National Registration. The worker should have a valid passport/travel document recognized by the Brunei Director of Immigration and National Registration, with a validity of more than 6 months before entering the country. The processing time for the employment visa is around 5 working days, and the visa application must be lodged by the employer directly to the work pass section of the department. Malaysian and Singaporean nationals are exempted from the employment visa requirement.

The employment pass, once obtained, remains valid for two years and can be renewed as needed.

Employee Background Checks

Legal and Background Checks

Background checks for employment purposes are not explicitly regulated by law in Brunei. However, employers are generally permitted to conduct background checks on job applicants as long as they do so in a fair and reasonable manner. This means that employers should:

- Obtain the applicant's consent: Employers must obtain the applicant's written consent before conducting a background check.

- Provide notice to the applicant: Employers must provide the applicant with notice of the type of background check that will be conducted and the information that will be collected.

Last updated on December 1, 2023

If you have any queries or suggestions, reach out to us at irene.jones@neeyamo.com

Heeft u vragen? Neem contact met ons op

Neem contact op met een van onze experts en neem een korte demo van onze diensten