Country Spotlight: Payroll in Oman

Aside from being home to some of the most beautiful Islamic architecture, Oman is rich in natural resources like oil and petroleum, rightly nicknamed the "Pearl of Arabia."

As one of the oldest Arab nations, it is blessed with a rich heritage and culture. That may be why when Oman's GDP grew by 4.5 percent in the first nine months of 2022, it didn't come as a surprise.

For a place that is extensively diversified in its economy, the approach toward its payroll processing needs to be methodical. For organizations planning to expand to this territory, it includes being cognizant of Oman's payroll taxes, the applicable leave conditions, and the validity and authenticity of employment contracts.

Payroll Tax Contribution in Oman

Oman is a hotspot for companies when they consider setting up businesses internationally. Usually, they employ a payroll management system that will help cater to their local needs. But before establishing, they need to know how various tax deductions are made to help make the right expansion decisions.

Employee and Employer Taxes

Employees in Oman are spared from contributing personal income tax. Instead, it is necessary to contribute to social security and job security funds.

Apart from the abovementioned contributions, employers must also make one for occupational injury and disease. Since both are updated annually, an agile payroll provider or system is mandatory to avoid fines.

You might also like - Global Payroll: 10 Trends that will be prominent in 2023

Holidays

A recent report indicates that companies incur costs between $2,600 and $3,600 per employee annually due to unscheduled sickness and vacation days.

In today's corporate world, it's very easy to fall prey to stress-related ailments.

Employees must be granted their share of leaves to disconnect from work and rejuvenate for a proper work-life balance. In Oman, employees can avail different types of leaves for their benefit.

Officially, Oman has 11-12 paid holidays:

- Prophet's Ascension (1 Day)*

- Eid al-Fitr (3-4 Days)*

- Eid al-Adha (3-4 Days)*

- Renaissance Day (1 Day)

- Islamic New Year (1 Day)*

- Prophet's Birthday (1 Day)*

- National Day of Oman (1 Day)

* Depending on the Moon Sighting.

Aside from the prominent public holidays listed above, Oman also provides its employees with the following leaves:

Sick Leave:

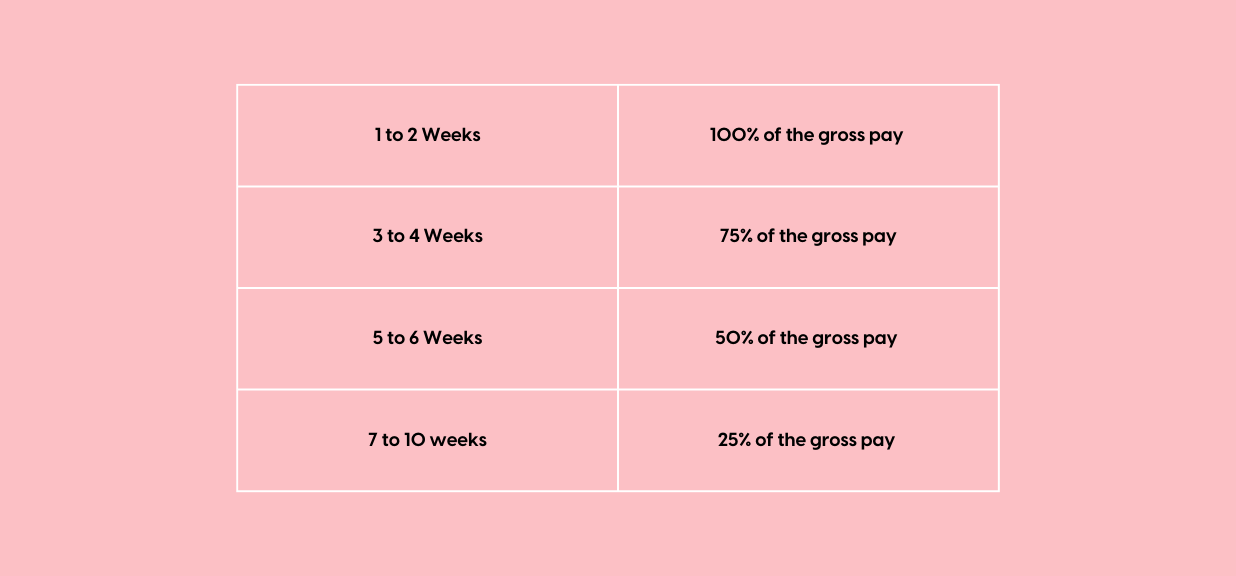

In Oman, employees are entitled to no more than 10 weeks of paid leave in a year. They are allotted in the following manner:

Maternity Leave:

A female employee is granted 50 days of paid leave and can avail it only three times with the same employer.

Hajj Leave:

Muslim employees can take up to 15 days of paid Hajj leave. But this applies only after an employee has provided one year of continuous service to an organization and can only be applied once for that particular organization.

Iddah Leave:

Post the separation from her husband in any form (whether death or divorce), a female employee is entitled to 130 days of paid leave.

These leaves don't include organization-specific policies and rules that need to be configured. With so many different criteria and validations that need to be applied depending on each employee, there is a need to have an absence solution that can be easily configured, remain compliant, and allows quick deployments.

Seamless employee exit management

Undoubtedly, dealing with the process of separation from an employee can be a tricky challenge.

Just like in other countries, in Oman, there are rules and regulations to be mindful of when someone decides to part ways with an organization.

Also Read: Common Payroll Challenges That Businesses Must Overcome

Notice Period

- According to the Omani Labor Law, organizations must provide an employee notice period. For employees working on a monthly salary basis, the notice period is for 30 days.

- For contracts that specify an alternate disposition, the notice period is stated as 15 days.

Failure to produce a written notice period compels the paying party to compensate the employee with the complete gross salary of the notice period.

Severance Pay

The severance pay for an employee is categorized based on the duration of the year they served in the organization:

- For the first three years, an employee will be reimbursed with 15 days of basic pay per year.

- If they have served for more than three years, then the employee will be paid 30 days of basic pay.

With such specific exit formalities, proactively guided process visibility can help both employers' and employees' part on good terms. So having an offboarding solution that offers an automated and structured solution that enables a seamless exit while ensuring compliance goes a long way.

Outsourcing Payroll in Oman

Ensuring payroll accuracy has become a challenge for organizations to achieve independently. Therefore, there has been a progressive rise in employing a single-integration-ready platform that addresses a payroll system's complexities.

Companies worldwide have begun to acknowledge this using payroll technology built on intelligent AI and ML-driven input/output validation.

With an established global presence and regional expertise in 160+ countries, Neeyamo is an industry leader in building country-specific gross-to-net payroll engines that guarantee faster payroll processing.

With Neeyamo's Payroll technology, companies can focus on fulfilling their vision while we take up the responsibility of sorting out the hassle associated with their payroll.

If you are curious about how you can make this work and ease out your organization's life, talk to our experts or write to us at irene.jones@neeyamo.com.

Nieuwste Bronnen

Blijf op de hoogte met de laatste updates

Als je nieuwsgierig bent en een dorst hebt naar kennis met betrekking tot het HR-, salarisadministratie- en EOR-universum, mis dan niet om je te abonneren op onze bronnen.